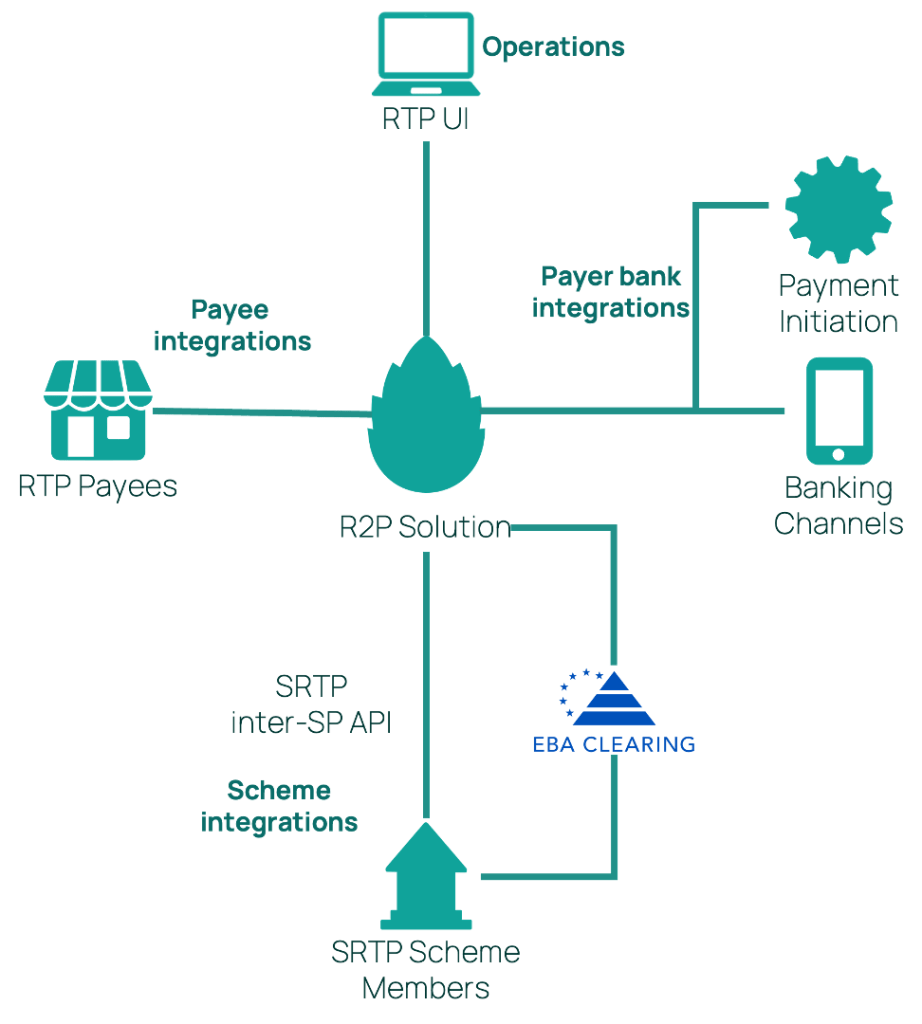

Pinecone’s SEPA Request-to-Pay (SRTP) solution offers a fully managed, advanced platform that seamlessly integrates with payees and is easy to incorporate into a bank’s existing IT infrastructure.

Key Features of Pinecone’s SEPA Request-to-Pay Solution

- Easy Integration: Our solution provides seamless integrations for payees and is designed to easily integrate with the bank’s IT infrastructure, minimizing disruption and ensuring a smooth transition.

- Unified Processing: Pinecone’s SRTP solution supports unified processing for different Request-to-Pay infrastructures, accommodating all use cases and providing a versatile platform for various payment scenarios.

- Modern IT Architecture: Built on a modern IT architecture, our solution offers industry-leading levels of scalability, reliability, and security. This ensures that your transactions are handled efficiently and securely, even as your needs grow.

- Compliance Simplification: By using Pinecone’s SRTP solution, banks can avoid the European Payments Council (EPC) SRTP scheme homologation process and the associated recurring compliance activities. This reduces the regulatory burden and simplifies ongoing compliance management.

- Value-Added Services: Beyond basic scheme compliance, our solution includes many value-added services, enhancing the functionality and utility of the SRTP platform. These services provide additional benefits and efficiencies for your payment processing needs.

Embrace the future of payment processing with Pinecone’s SEPA Request-to-Pay solution. Experience seamless integration, enhanced security, and a suite of value-added services designed to meet all your payment processing needs.

Buy Now Pay Later and Due Date Extension opportunity for Banks

Buy Now Pay Later

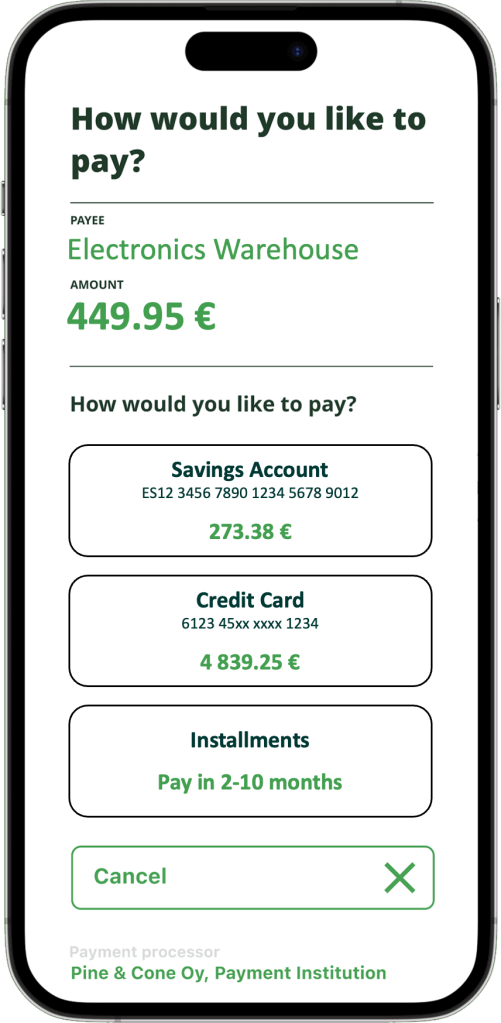

The approval of Request-to-Pay serves as the ideal channel for implementing BNPL solutions for both consumer and SME customers, particularly for e-commerce and in-app payments. This method allows customers to:

Fund Payments Flexibly: Payments can be funded from a credit card balance or through instalment plans, offering flexibility and convenience.

Seamless User Experience: Interaction occurs within the mobile banking application, a trusted environment that eliminates the need for additional data entry and authentication. This enhances security and streamlines the payment process.

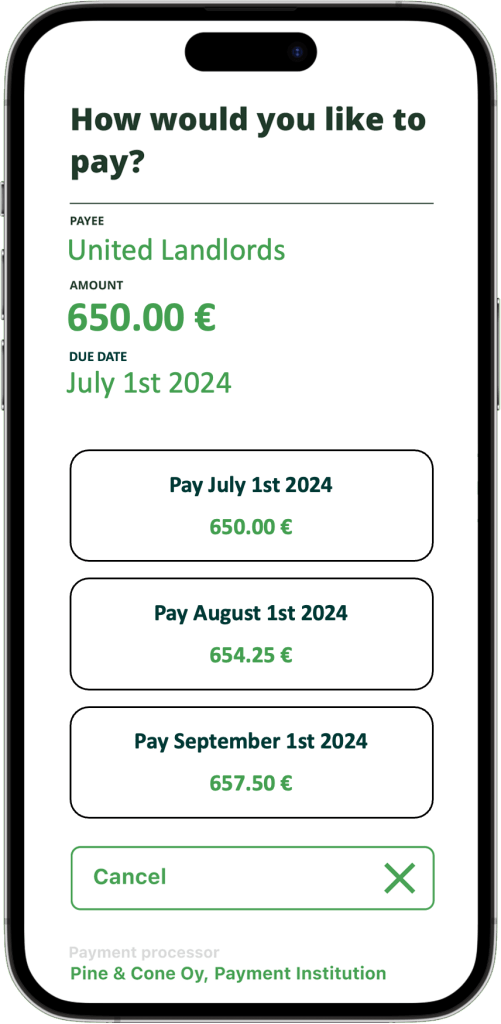

Due Date Extension

AI-Optimized Offers: Utilizing AI, banks can optimize due date extension offers to align with the customer’s income cycle, providing personalized and timely financial support.

Enhanced Service: Extending the due date for invoices is a valuable service, more positively received than traditional consumer lending products. It is perceived as a customer-centric service provided by the bank.

Seamless Integration: The process integrates smoothly with existing invoice approval workflows, ensuring minimal disruption and maximum efficiency.